HowardSimon has worked with employers nationwide to provide retirement plans that find the right balance between being a true employee benefit versus a retirement vehicle exclusively for owners and executives. After gaining a thorough understanding of your objectives, our retirement plan specialists devise plans with maximum tax benefits and minimum tax burdens for employers.

We earned our leadership status in retirement plan administration by providing customized retirement plans supported by attentive customer service. People like working with us. Our team approach helps us to deliver continuous support to clients. Many of our administrators have been with the firm for over 20 years. Because of the long tenure of our staff, our team develops a bond with our clients and a deep understanding of their retirement needs.

We also recognize the importance of effective communication to ensure participants truly understand and appreciate their retirement plans. Unlike other providers who utilize call centers, our clients receive direct dial support so they can quickly and easily contact a familiar representative. Our method increases efficiencies and eliminates unnecessary hassles.

With an in-depth understanding of retirement planning, HowardSimon creates plans that utilize the full extent of the tax code. Our experience affords us the ability to customize a retirement plan that serves the maximum purpose for your business. By remaining conscious of market factors and shifting government regulations, our retirement plan experts dedicate themselves to creating practical plans to satisfy your objectives. HowardSimon does not use "cookie cutter" plan concepts; we design a plan for you.

Whether looking to change an existing plan or looking for us to design a new one, we deliver a wide range of plans, including:

Our meticulous recordkeeping closely monitors contribution rates, investment selections, balances, account statements and outstanding loans. As a trusted recordkeeper of retirement plans, we ensure complete and accurate plan records as well as the proper processing of necessary transactions.

Advantages of our diligent recordkeeping include:

Fiduciary services provided by HowardSimon protect employers from facing fines or penalties for failing to satisfy fiduciary responsibilities. Along with offering diverse investment options and properly managing required documentation, our 3(16) fiduciary services appoint HowardSimon as a plan administrator to assume liability alongside our client. With extensive experience and in-depth knowledge of retirement planning and compliance, HowardSimon confidently assumes the role of co-fiduciary.

3(16) Fiduciary Services Include:

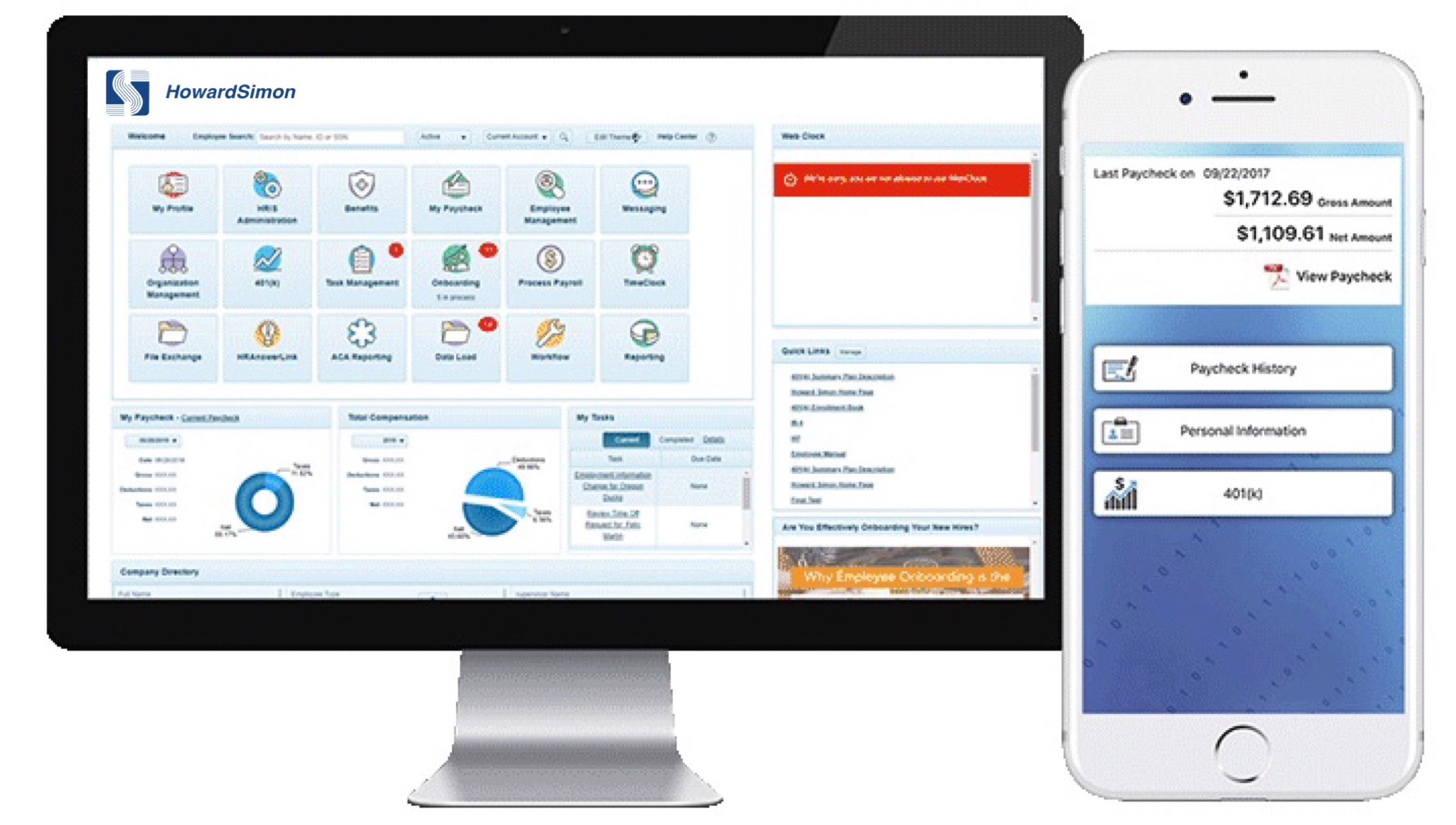

Combine information from your payroll to your retirement plan with HowardSimon's effective payroll integration. Our proficient system automatically transfers information, saving you time and money. A single portal takes the burden off of your staff to move data between platforms and greatly increases accuracy.

Advantages of payroll integration include:

Access employee data on the go with HowardSimon's exclusive HowardSimon Mobile. Stay connected to your business from anywhere, at any time, whenever is convenient for you. Downloadable on the App Store.

HowardSimon is registered with the Department of Labor to be a Pooled Plan Provider, this combined with our over 40 years of plan administration experience make HowardSimon the ideal partner for your Pooled Employer Plan. PEPs have the potential to offer many advanatages, including: